W4 allowance calculator

Enter YTD data for increased. You are presented with an amount that you owe in taxes from the.

How To Calculate Federal Income Tax

You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form.

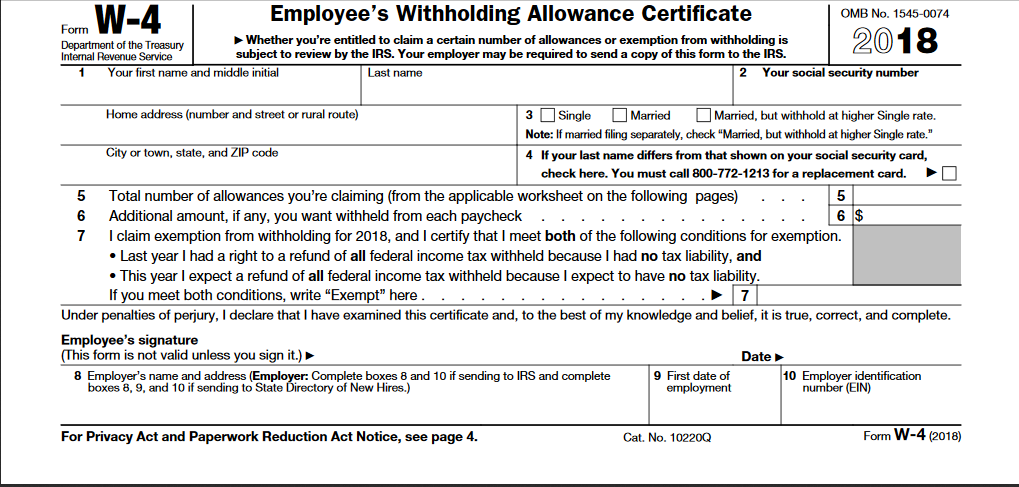

. Need to adjust both your federal and state withholding allowances go to the Internal Revenue Service IRS website and get Form W-4 Employees Withholding Allowance Certificate. That result is the tax withholding amount. The personal allowance for 2019 is 12200.

250 and subtract the refund adjust amount from that. 250 minus 200 50. IRS tax forms.

The 2020 W-4 form wont use allowances but you can complete other steps for withholding accuracy. Download or Email IRS W-3 More Fillable Forms Register and Subscribe Now. W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from.

Afraid You Might Owe Taxes Later. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Ask your employer if they use an automated.

To change your tax withholding amount. Projects taxable income and calculates required withholding allowances. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

Up to 10 cash back Maximize your refund with TaxActs Refund Booster. Any results this calculator yields will be. Your tax liability is the amount of money that you owe to the government in federal.

Are You Withholding Too Much in Taxes Each Paycheck. Dont Just Hand It Over Only to Get It Back With Your Return. If you happen to have a second job youll need to complete the additional steps.

The amount of income earned and the information provided on Form W-4 calculate. Withholdings are not based on your personal or dependency exemptions. If you have any dependents you can claim an additional allowance for each one.

Were about to look at the need-to-know for the W-4 form and provide you with our W-4 calculator so you can make sure youre on the right path. It is important that your tax withholding match your tax liability. As a general rule the fewer withholding allowances you enter on the Form.

Are You Withholding Too Much in Taxes Each Paycheck. Ad Keep More Of Your Money Now. Our withholding calculator doesnt ask you to provide personal.

Ad Keep More Of Your Money Now. There is no need to complete the worksheets that accompany Form W-4 if the calculator is used. Then look at your last paychecks tax withholding amount eg.

Afraid You Might Owe Taxes Later. Dont Just Hand It Over Only to Get It Back With Your Return. W4 Calculator Adjust payroll withholding throughout the year FEATURES.

For instance it is common for working. Employees must complete Form W-4 when starting a new job annually or whenever there are changes. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck. Oregons withholding calculator will help you determine the number of allowances you should report on Form OR-W-4.

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

W 4 Form What It Is How To Fill It Out Nerdwallet

United States W 4 Allowances Irs Calculator Personal Finance Money Stack Exchange

High Income Wage Earners Need To Review Their W 4

How Many Tax Allowances Should I Claim Community Tax

Irs Improves Online Tax Withholding Calculator

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Withholding Tax Youtube

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

2020 W 4 Updated

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

W 4 Changes Allowances Vs Credits Datatech

W4 Calculator Cfs Tax Software Inc Software For Tax Professionals

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form